Film Finance: Inside Hollywood’s Balance Sheet

When most people think about investing in films, they imagine backing the next blockbuster. However, the smartest money in Hollywood isn’t betting on hits, but providing secured…

The LX Film Finance Fund targets an under-penetrated and largely misunderstood niche of specialty finance that offers the potential to achieve 15-20% annualized gross returns – through primarily asset-backed or collateralized short-term lending.

Similar to working capital finance,

film financing targets short term lending across various stages of a film’s production process that are typically backed or collateralized by specific production assets – generating investment outcomes that are uncorrelated to the box office success of the film.

Our approach distinguishes itself by integrating credit analysts within a team of film industry veterans embedded in the production process to preemptively identify and manage lending risks.

The fund seeks to actively manage outcomes to capture higher returns as compensation for changes in risk and intends to offer a base of yield oriented income.

Production Partner Financings

Hotel Tehran

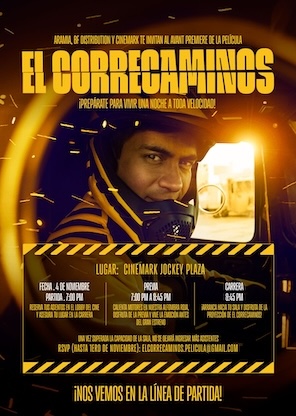

El Correcaminos (Peru)

The Neglected

The Knife

Joe Baby

Crescent City

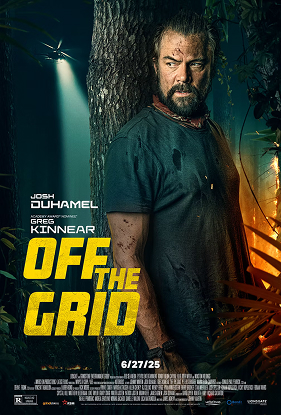

Off the Grid

LX Film Finance at the 2025

Cannes Film Festival

Our latest thinking on industries and emerging markets to watch.

When most people think about investing in films, they imagine backing the next blockbuster. However, the smartest money in Hollywood isn’t betting on hits, but providing secured…

In an era where market-beating returns from alternative assets is increasingly demanding, there’s a compelling investment opportunity hiding…

The strategic minerals sector is a global industry that involves the extraction, processing, and supply of minerals that are vital for economic, military, and technological…